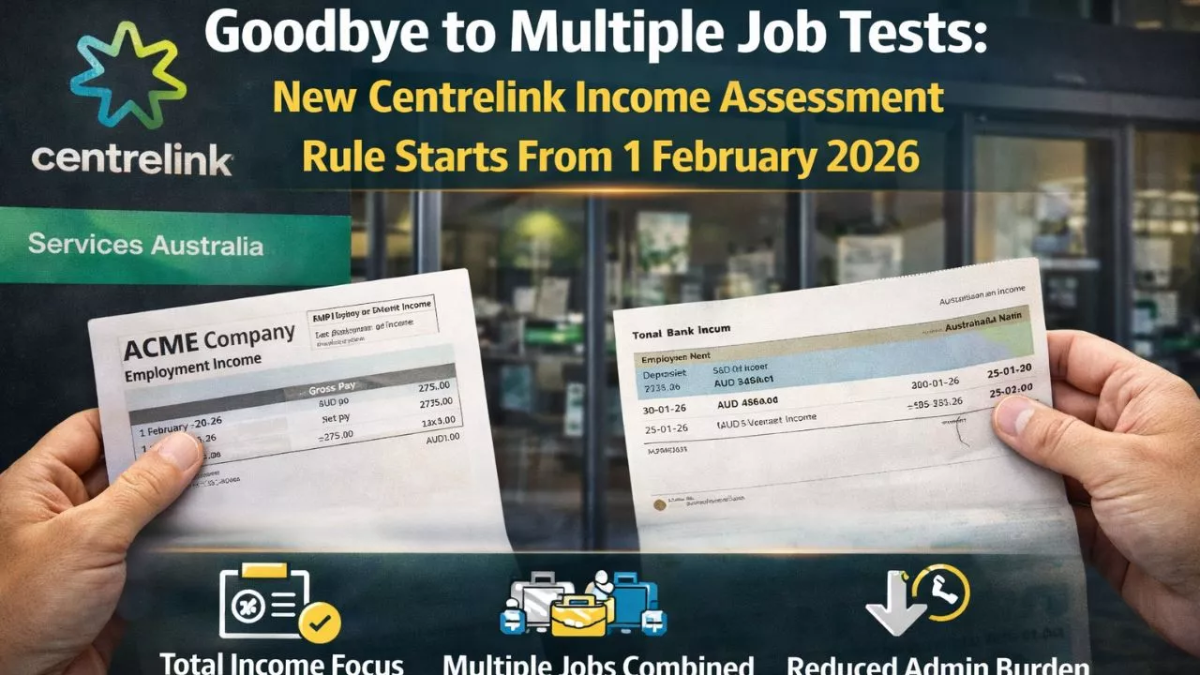

From 1 February 2026, a major Centrelink rule change is set to simplify income assessment for thousands of Australians receiving income support. The new update removes the need for multiple job tests across different payments, replacing them with a more streamlined and practical assessment system. For many recipients, this means less paperwork, fewer reporting errors, and reduced stress when managing work and welfare together.

The reform is being rolled out as part of broader welfare system improvements managed by Services Australia, which oversees Centrelink payments. The aim is to make income reporting fairer and easier while still encouraging workforce participation.

What the Centrelink Job Test Rule Change Is About

Until now, many Centrelink recipients had to meet different job test or income assessment requirements depending on the payment they received. This often created confusion, especially for people juggling part time, casual, or variable work hours.

From February 2026, Centrelink will move toward a single, simplified income assessment approach. This change reduces duplication and ensures that work effort is assessed more consistently across eligible payments.

Why the Government Is Removing Multiple Job Tests

Multiple job tests were often criticized for being complex and outdated, particularly in a modern workforce dominated by casual, gig, and flexible employment. People working fluctuating hours frequently struggled to meet rigid requirements despite actively participating in the workforce.

The new rule recognizes real world work patterns and focuses on actual income earned rather than forcing recipients to comply with multiple overlapping tests.

Who Will Be Affected by the New Income Assessment Rule

The update mainly affects working age Centrelink recipients who receive payments linked to employment expectations. This includes people on job related income support who report earnings regularly.

Those with casual or part time jobs are expected to benefit the most, as the new system better accounts for variable income without triggering repeated compliance issues.

How Income Will Be Assessed From February 2026

Under the new rule, income assessment will focus on reported earnings over a set period rather than separate job test thresholds. This means recipients will no longer need to meet different work requirements for different payments at the same time.

Income reporting remains essential, but the assessment process becomes more predictable and aligned with actual pay cycles.

What This Means for Fortnightly Payments

With fewer job tests, payment calculations are expected to be more stable. Recipients may see fewer unexpected reductions or suspensions caused by technical non compliance rather than genuine changes in work activity.

This improves budgeting confidence and reduces the risk of overpayments or debts caused by reporting misunderstandings.

Will Mutual Obligation Requirements Still Apply

While multiple job tests are being removed, mutual obligation requirements do not disappear entirely. Some recipients may still need to meet agreed participation activities, depending on their payment type and personal circumstances.

However, these requirements are expected to be clearer and more tailored under the updated framework.

How This Change Helps People Move Into Work

By simplifying income assessment, the new rule reduces fear around taking up extra shifts or short term work. Many recipients previously avoided additional hours due to concern about breaching job test rules.

From 2026, the system is designed to better support gradual transitions into work rather than penalizing irregular income.

What Recipients Need to Do Before February 2026

Most recipients do not need to apply for this change. The new income assessment rule will be applied automatically from 1 February 2026.

However, it is important to keep income details accurate and up to date. Reporting earnings correctly remains essential to ensure payments are calculated properly.

Common Misunderstandings About the New Rule

One common misconception is that job requirements are completely removed. In reality, the change removes duplication, not responsibility.

Another misunderstanding is that income no longer affects payments. Earnings will still influence payment rates, but assessment will be simpler and more transparent.

What Happens If Income Changes Suddenly

If income increases or decreases significantly, recipients must still report changes as required. The new system is designed to adjust payments more smoothly without triggering unnecessary compliance actions.

This helps prevent sudden payment stoppages caused by short term income spikes.

Conclusion

The Centrelink income assessment rule starting from 1 February 2026 marks a significant improvement for income support recipients. By removing multiple job tests and simplifying income assessment, the system becomes fairer, clearer, and better suited to modern work patterns. While reporting obligations remain, the reduced complexity offers real relief for people balancing work and Centrelink payments. Staying informed and keeping income details accurate will help recipients benefit fully from this important reform.

Disclaimer: This article is for informational purposes only. Centrelink rules, eligibility, and obligations may change based on official government updates and individual circumstances.